Preparing and Submitting IRS Refund Claims

The IRS erroneously denies many timely refund claims

Around the filing deadline each year, besides last-minute tax craziness, there are always questions about either late-filed or amended returns and whether or not a particular refund claim is timely.

We should not assume that a refund claim is time-barred simply because an original or amended return would be filed more than three years from the unextended due date for that tax year. The refund statute of limitations is complex, and it is quite possible that a refund claim filed many years after the unextended due date is timely.

If you want more information on the refund statute of limitations, please read my prior overview or take my 1 CE/CPE webinar through Compass Tax Educators.

Determining the Refund Amount

Getting an IRS account transcript for a particular year is essential to determine if a refund claim is still within the refund statute period. There are three key data points available on the IRS account transcript:

The original return filing date (or confirmation of non-filing). This determines whether a refund claim would be timely under the three-year or two-year prong of the refund statute and the applicable lookback period.

Whether or not an extension was filed for that tax year. If a refund claim is timely under the three-year prong, the lookback period is three years plus the extension period (six months for Form 1040).

Whether or not additional payments were applied to that tax year. Payments could include voluntary taxpayer payments, refund offsets, or IRS levy payments. A payment could be refundable if it falls within the applicable lookback period.

Advocating for the Refund Issuance

Whenever submitting an original or amended return as a refund claim, it is critical to calculate the refund amount that should be issued and explain to the IRS in writing why that amount should be refunded. The IRS often improperly denies timely refund claims, primarily based on the two-year prong of the refund statute.

In Chief Counsel Advice 201321022, the IRS admitted that its computers cannot properly apply the refund statute of limitations (ignoring the two-year prong) since it is so complicated:

...The section 6511 rules are so complicated that the system cannot currently be programmed to figure out every situation...

…Currently, the RSED date is set to three years after the extended deadline and remains at that date even if the taxpayer files prior to the extension date...

…The safest bet, then, is to keep the RSED three years from the statutory deadline or, if that deadline is extended, to the earlier of the extended due date or the return received date...

Do not simply accept an improper IRS claim disallowance. The taxpayer should receive the right to contest the denial in the IRS Independent Office of Appeals, and a protest should be filed in response to all erroneous refund claim disallowances.

Example 1: Late-Filed Original Return

John never filed a tax return or extension for tax year 2016, and the IRS made a §6020(b) substitute for return assessment for that year. The IRS offset the following federal tax refunds to the balance owed:

2021 return - $1,226, which was deemed paid on April 15, 2022

2022 return - $2,330, which was deemed paid on April 15, 2023

2023 return - $225, which was deemed paid on April 15, 2024

Assume that an original 2016 return is prepared, showing a $350 refund from withholding, and it is filed with the IRS in May 2025. As a reminder, under §6513(b)(1), amounts from withholding are generally deemed paid on April 15, 2017.

The following analysis should be included in a cover letter submitting the original return to the IRS:

While the refund shown on the return from withholding is time-barred under the refund statute of limitations, the taxpayer is otherwise entitled to a refund of all other payments made within the three years immediately preceding the filing date of this tax return. See Internal Revenue Manual 4.13.1.5.3.6(2)(c). Therefore, the taxpayer is entitled to a refund of $2,555: $2,330 (deemed paid on April 15, 2023) plus $225 (deemed paid on April 15, 2024).

Example 2: Amended Return Relying on Two-Year Prong

The IRS examined Anna’s timely filed 2020 tax return, and she paid the resulting $6,554 balance due on November 3, 2023. Anna later determined she did not claim a tax deduction she was entitled to and prepared Form 1040-X for tax year 2020, showing a $2,000 refund. She filed the Form 1040-X with the IRS in May 2025.

The following analysis should be included in the Form 1040-X explanation of changes:

The taxpayer made a $6,554 payment on November 3, 2023 toward her 2020 tax account; therefore, the $2,000 refund claim is timely and should be paid in full since it was filed within two years of this payment date. See §6511(b)(2)(B) and Internal Revenue Manual 25.6.1.10.3.3(2), Row 2.

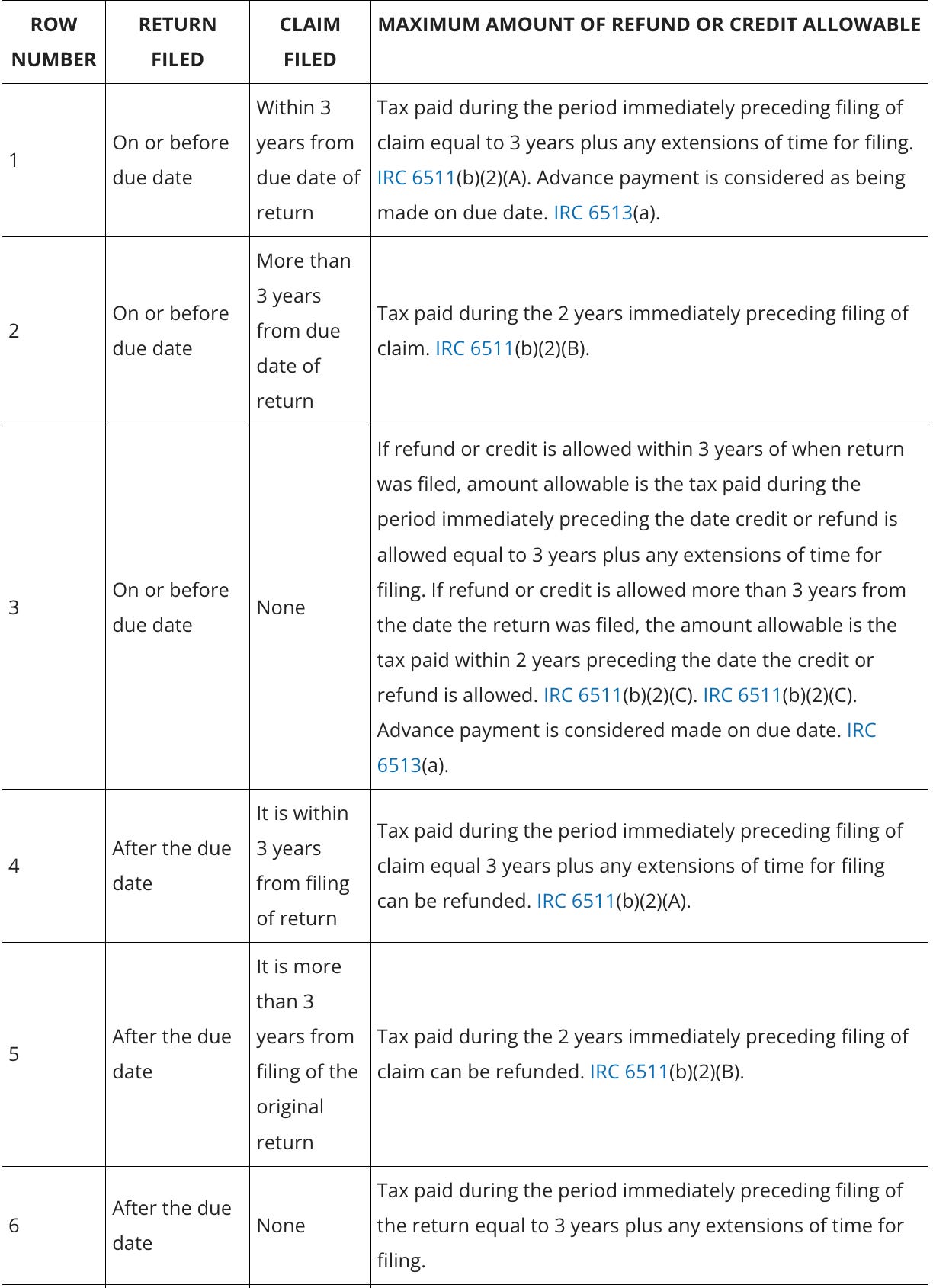

Internal Revenue Manual 25.6.1.10.3.3(2) has an extremely useful refund statute of limitations table for easy reference:

Example 3: Qualified Wildfire Relief Payment Exclusion

Paul and Joel filed a joint return for the 2020 tax year, claiming a wildfire relief payment as income. This payment is now excluded from income as a qualified wildfire relief payment under §3(a) of the Federal Tax Disaster Relief Act of 2023, which was enacted into law as Public Law 118-148 on December 12, 2024.

Paul and Joel prepared Form 1040-X for the tax year 2020, showing a $21,500 refund. They filed the Form 1040-X with the IRS in May 2025.

§3(e) of the law extended the refund statute related to this exclusion so that it could not expire before December 12, 2025, and the provision also waived the relevant lookback period limitation for all refund claims related to this exclusion. The Federal Tax Disaster Relief Act of 2023 provisions were not codified into the Internal Revenue Code; a proper citation to this provision is to the law itself.

The IRS failed to create a special procedure to process these refund claims; therefore, the following analysis should be included in the Form 1040-X explanation of changes:

This refund claim is entirely allocable to a qualified wildfire relief payment, which is excluded from income under §3(a) of Public Law 118-148. Under §3(e) of Public Law 118-148, this refund claim is timely because it was filed on or before December 12, 2025, and the entire $21,500 should be refunded because the provision waived any limitation based on the dates that payments were made.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please take a look at my website to learn about the educational opportunities I offer the tax professional community.