An Overview of the Refund Statute of Limitations

Refund statute issues can quickly become complex

Anytime a taxpayer has an overpayment of tax and requests a refund, whether it is an original return, an amended return, or another document filed with the IRS, the amount must be refundable within the §6511 refund statute of limitations (RSOL).

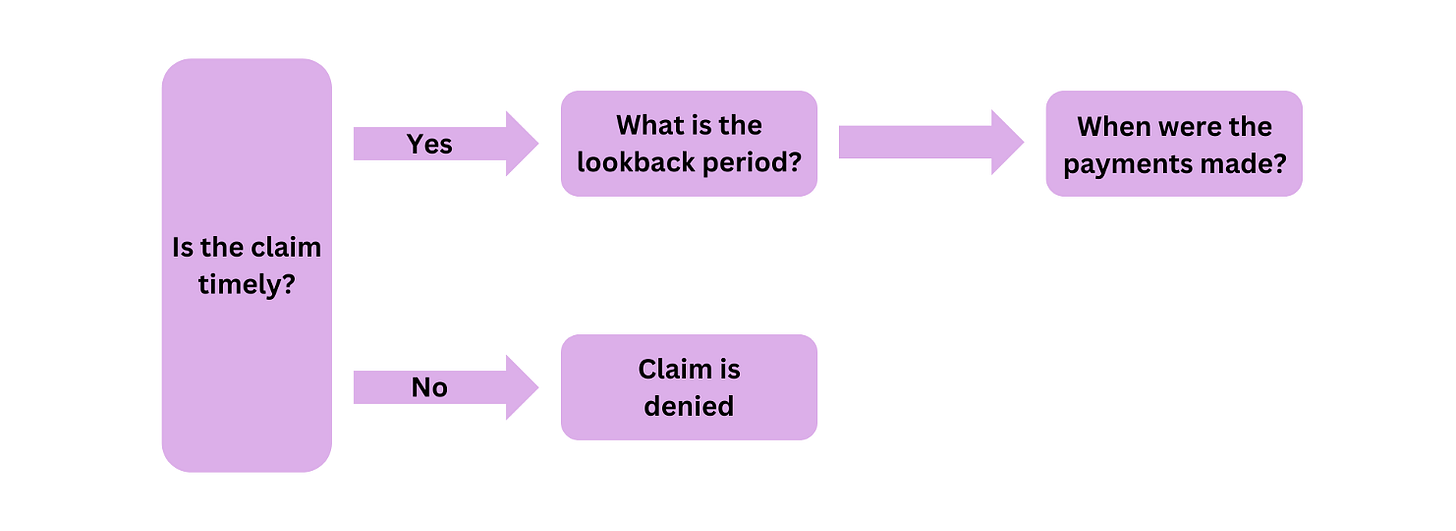

The following chart shows the general process for analyzing an RSOL issue:

Below is the analysis applicable to many RSOL issues. However, it is important to note that some provisions, such as net operating loss carrybacks and foreign tax credit claims, have unique RSOL issues that are not covered in this article.

Is the Claim Timely?

Under §6511(a), if a return is required to be filed, a claim is timely if filed on or before the later of three years from the filing date or two years from the payment date. If no return must be filed, a claim is timely if filed on or before two years from the payment date.

What Is the Lookback Period?

If a claim is timely, the refundable amount is limited to the tax payments made within the applicable lookback period.

Under §6511(b)(2), if a return is timely under the three-year prong, the lookback period is the three years immediately preceding the claim filing date plus the filing extension period, if applicable. In all other cases, the lookback period is the two years immediately preceding the claim filing date.

When Were the Payments Made?

Under §6513(b)(1), any tax withheld under Chapter 24 of the Internal Revenue Code, which includes wage withholding, is deemed paid on the 15th day of the fourth month after the close of the tax year for which the tax would be credited; thus, for the 2023 Form 1040, it is April 15, 2024.

Under §6513(b)(2), estimated tax payments are deemed paid on the tax return due date, not including extensions; thus, for the 2023 Form 1040, it is April 15, 2024.

Under §6513(c)(2), payroll taxes are generally deemed paid on the April 15th of the succeeding calendar year; thus, for the 2024-03 Form 941, it is April 15, 2025.

All other payments are deemed paid on the date the IRS receives them.

Basic Example

Marisol did not file her 2021 Form 1040 or a timely extension. Fearing she would owe the IRS, she made a $3,500 payment on November 1, 2022. She had $7,200 in wage withholding, deemed paid on April 15, 2022.

Marisol’s 2021 Form 1040 shows a $1,200 overpayment since payments made after the unextended due date are not included; however, if the extra payment is factored in, the actual overpayment is $4,700.

When she files the return, her claim for refund is simultaneous with the return filing, so the three-year prong is met, and the three-year lookback rule will apply. See Internal Revenue Manual 25.6.1.8.2(6) (02-03-2023).

Therefore, to receive the entire $4,700, she must file the return by April 15, 2025, as both the withholding and the payment will fall within the three-year period. If she files after this date but on or before November 1, 2025, her refund is limited to $3,500 since that payment will fall within the three-year period. If she files after November 1, 2025, her claim will be timely, but since there will be no refundable payments in the prior three years, the claim will be disallowed.

IRS Often Misapplies the Refund Statute

If a return or claim is filed more than three years after the tax return's unextended due date, the IRS often misapplies the RSOL and denies valid claims. A taxpayer should protest the claim denial with the IRS Independent Office of Appeals. An IRS account transcript is essential for an RSOL analysis, both pre-filing and post-filing.

When filing an amended return with an unusual statute of limitations issue, it is best practice to provide details in the explanation of changes as to why the refund is allowed under the RSOL.

Share Your Thoughts

You can discuss this topic in the comments section if you are a paid subscriber. Please keep the discussion related to this edition’s topic.

More Information?

I am teaching a one CE/CPE webinar on the Refund Statute of Limitations for Compass Tax Educators on September 5, 2024. Join us!

Introducing InCite

This month, I was excited to announce the launch of a new tax professional community called InCite. Join hundreds of tax pros committed to technical accuracy and improving their businesses in a collegial atmosphere. Learn more and join us here!

I understand that if the refund claim is not filed timely then it will be denied. What about receiving credit the withholding/estimated tax payments? The taxpayer would still be able to use these payments to offset taxes owed, they just couldn't receive a refund of any excess withholding. Is that correct?