There is a misconception that tax planning is only for active business and rental activity owners, and once retired, the need for tax planning has ceased. Tax planning is essential in retirement to reduce a taxpayer’s overall tax and related costs to help preserve their assets in case of longevity.

For individuals who reach age 65, Medicare premiums are a required monthly expense. The 2023 Part B premium is $163.90 monthly or $1,966.80 yearly. While Medicare premiums generally increase annually due to inflation, they can also spike due to the Income-Related Monthly Adjustment Amount (IRMAA) surcharge. IRMAA is not the retiree’s friend but can be mitigated or avoided with tax planning.

Whether or not IRMAA applies is determined by filing status and modified adjusted gross income (MAGI). MAGI for IRMAA purposes is AGI plus tax-exempt interest.

The IRMAA surcharge for a particular year references the filing status and MAGI from a prior tax year. For example, the 2023 IRMAA surcharge was determined using 2021 tax return data.

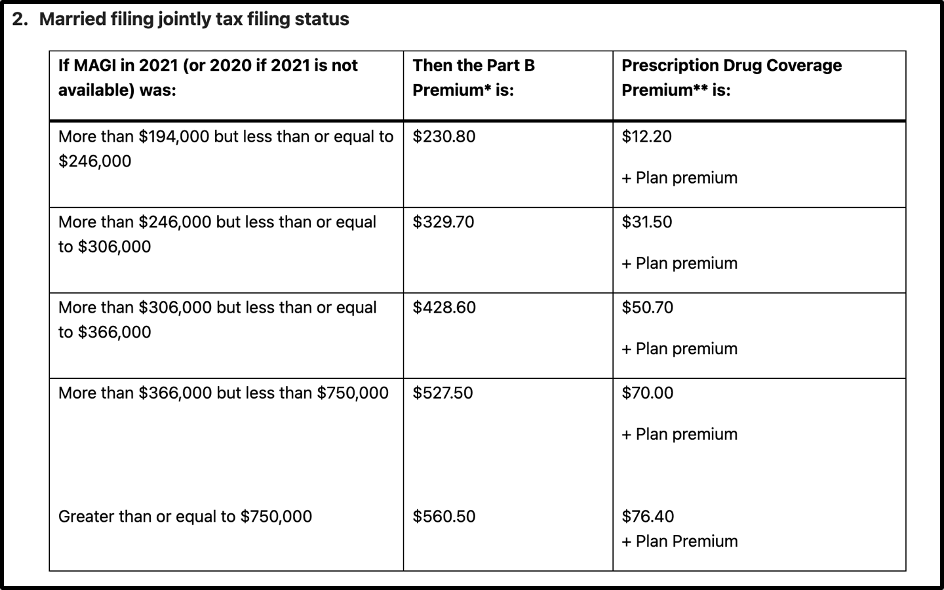

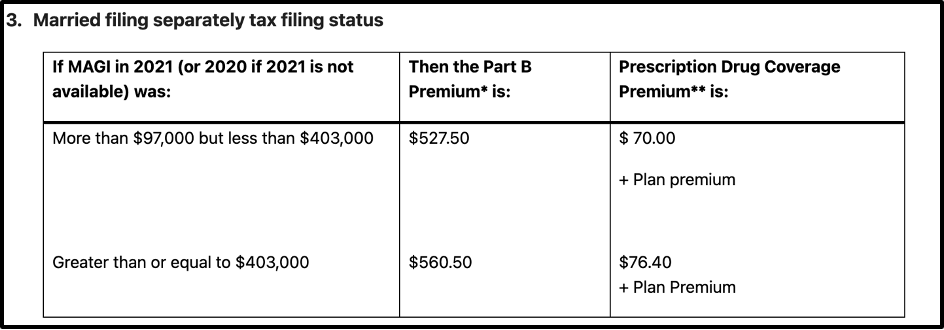

Here are the 2023 IRMAA amounts based on filing status:

Using the above tables, a single individual whose MAGI goes from $96,000 to $124,000 has a $165.80 monthly increase in their Medicare premiums. This is an additional $1,989.60 per year, which is 7.1% of the $28,000 income increase. While the IRMAA surcharge is not an income tax, it is an income-related expense that should be factored into determining the marginal tax rate paid on additional income.

A taxpayer can request an IRMAA reduction due to certain life-changing events using Form SSA-44. Examples of life-changing events include marriage, divorce/annulment, death of a spouse, work stoppage, work reduction, loss of income-producing property, loss of pension income, and employer settlement payment.

For example, if in 2023 a taxpayer is fully retired but was working full-time in 2021, they can request an IRMAA reduction since their 2021 income does not reflect their 2023 economic situation.

Anyone receiving Medicare should avoid the married filing separately (MFS) filing status if they live with their spouse anytime during the year; these taxpayers are subject to very high IRMAA surcharges at relatively low-income levels.

When a taxpayer files MFS, it is assumed they lived together during the tax year; if the taxpayer did not, they can petition to use the “single” IRMAA table and receive an IRMAA reduction. Under §6013(b)(2), two married taxpayers who filed separate returns have three years from the unextended due date to elect a joint return.

Besides avoiding the MFS filing status, all other IRMAA planning focuses on keeping AGI and MAGI as low as possible. Of course, this has other beneficial effects in retirement, such as lowering overall tax, lowering long-term capital gain tax rates (potentially down to the 0% bracket), and mitigating Social Security benefit taxation.

Strategies to reduce AGI and MAGI in retirement include the following:

Use tax-free Roth IRA and health savings account (HSA) qualified distributions to fund retirement expenses after Medicare eligibility.

Roth IRA conversions at least two years before receiving Medicare benefits to increase the availability of future tax-free qualified distributions and decrease future required minimum distributions (RMDs).

Harvest capital losses from a stock portfolio to offset other long-term capital gains.

Donate long-term capital gain stock to meet charitable giving goals and avoid recognition of the long-term capital gains.

Use tax-free qualified charitable distributions to meet charitable giving goals and avoid taxable RMDs.

It is important to note that qualified dividends and long-term capital gains flow into AGI and MAGI even though they are subject to lower tax rates, including potentially a 0% federal tax rate. As such, they can contribute to a taxpayer being subject to an IRMAA surcharge.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please look at my Linktree to learn about the educational opportunities I offer the tax professional community.

Contact Us

Please email us at support@tomtalkstaxes.com with suggestions for future editions or any assistance with your subscription. We will generally respond within two business days to your inquiry.

Love the fact I learned that HSA contributions can be saved up and used for Part B premiums later

No. That is not a tax issue.