Tax Law is Uncertain (And I Feel Fine)

I often hear from tax professionals we need “guidance” from the IRS on various tax provisions. Guidance, guidance, guidance — give it to us now!

Our ethical obligation is met on a tax return, and we avoid preparer penalties under §6694 and accuracy-related penalties under §6662, as long as a tax return position has a reasonable basis and is adequately disclosed on the tax return. That’s a relatively low standard: it simply must be reasonably based on one or more of the authorities set forth in Treasury Regulation §1.6662-4(d)(3)(iii). In the hierarchy of standards, it is above “not frivolous” but below “substantial authority” or “more likely than not.”

We can get a reasonable basis for a tax return position from a plain reading of the statutory text, or a Congressional report interpreting a law passed by Congress, or using deductive logic by looking at multiple authorities (for example, the Internal Revenue Code plus a revenue ruling interpreting that part of the Code).

We also can have a reasonable basis for completely opposite positions on the same tax issue.

For tax returns, we don’t need “more likely than not”, and we certainly don’t need “beyond a reasonable doubt”, which is only reserved for criminal matters. Of course, we want to prepare a complete and accurate return whenever we can, but many times that requires professional judgment and reasonable assumptions because the practice of tax is the practice of law, not the practice of accounting.

Because tax is law, most tax positions live in the world of gray, where facts and circumstances are key and a persuasive argument wins the day. Embrace ambiguity and use it in your client’s favor after a frank discussion with the client. Disclose your position when necessary on Form 8275, Disclosure Statement, or in accordance with Rev. Proc. 2019-42.

Don’t be a tax professional who demands everything be beyond a reasonable doubt. You’ll be chasing the pot of gold at the end of the rainbow for the rest of your career.

Married Filing Separately - Better for 2020?

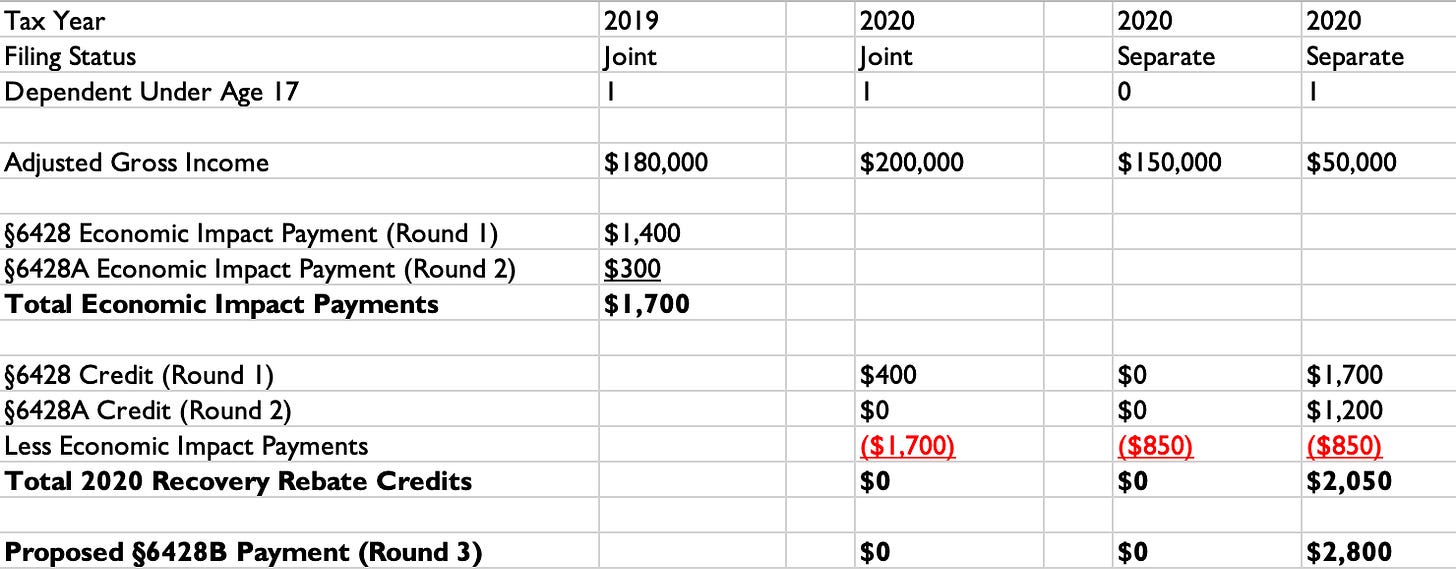

In most circumstances, married individuals have an overall lower tax liability on a joint return versus two separate returns. However, because of quirks related to the 2020 recovery rebate credits — joint economic impact payments are split equally between spouses and there is no clawback of economic impact payments — it may make sense for some married couples to file separately for tax year 2020.

In some cases, the increased 2020 recovery rebate credits may outweigh the additional tax from separate returns. Let’s look at an example where filing separate 2020 tax returns generates $2,050 in additional 2020 recovery rebate credits and potentially gets them an additional $2,800 economic impact payment from the proposed American Rescue Plan Act of 2021.

This year more than ever, don’t assume a joint return for a married couple will always be the optimal outcome. Do the analysis and demonstrate your expertise to your clients.

Tax Treatment of COVID-19 Tax Benefits

I wrote a handy one-page summary of how a taxpayer treats various COVID-19 benefits on the tax return, such as PPP loan forgiveness, the employee retention credit, and the paid sick and family leave credits. You can get it for free here.

Articles I Recommend

Amber Gray-Fenner, EA, USTCP wrote a great article in Forbes on the poorly worded question the IRS asks on Form 1040 related to cryptocurrency transactions. I own cryptocurrency, and I find it confusing.

My Upcoming Education Events

Compass Tax Educators, of which I am a co-owner, is offering its annual all-access pass for all live webinar events from May 1, 2021 through April 30, 2022. We guarantee we will offer at least 30 CE/CPE. You can see the courses planned and purchase a pass here.

Employee Retention Credit Update - March 9, 2021 (virtual)

We will focus on Notice 2021-20 and intersection of PPP loans and the credit, but will cover other issues as well.

American Rescue Plan Act of 2021 - March 16, 2021 (virtual)

This is the reconciliation bill working through Congress. There are many significant changes for tax year 2021 relates to common Form 1040 tax credits as well as other miscellaneous provisions (including Form 1099-K filing requirements!).

Virginia Society of Enrolled Agents Spring Seminar - June 2-4, 2021 (virtual)

Introduction to IRS Representation (2 CE)

Arizona Society of Enrolled Agents Southwest Fest- June 14-16, 2021 (virtual and live)

Advanced Rental Property Tax Issues (4 CE); COVID-19 Hot Topics for 2020 Tax Returns (2 CE); Penalty Abatement Strategies (2 CE)

National Association of Enrolled Agents (NAEA) National Tax Practice Institute - June/July 2021 (virtual)

Level 1: Statutes of Limitations (2 CE); Ethics (2 CE)

Level 2: Penalty Abatement Strategies (2 CE); Capstone Course (co-teaching with Clarice Landreth) (2 CE)