Tom Talks Taxes - April 14, 2023

In what tax year does a taxpayer claim a §25D residential clean energy credit?

Adding solar electricity to a residence can take months, and more typically years, from initial payment until activation. Since this process often crosses tax years, there is confusion about when a taxpayer can take the §25D residential clean energy credit for the expenditure.

§25D(a) states the credit equals 30% of the qualified solar electric property expenditures made by the taxpayer during such year. However, §25D(e)(8)(A) requires that an expenditure is treated as made when the original installation of the item is completed. The installation date, not the payment date, determines the tax year in which the taxpayer claims the §25D credit.

The term “installation” is not defined in §25D or any existing guidance on §25D, such as Notice 2013-70 or Fact Sheet 2022-40. Because of this, I often see the term “placed in service” used as a substitute; however, placed in service is not used in §25D or its guidance.

The placed in service date is most often used to determine when the depreciation of an asset begins. Treas. Reg. §1.167(a)-11(e)(1)(i) states that property is considered placed in service when it is “placed in a condition or state of readiness and availability for a specifically assigned function.” It is important to note that the use of the property does not have to start for it to be considered placed in service.

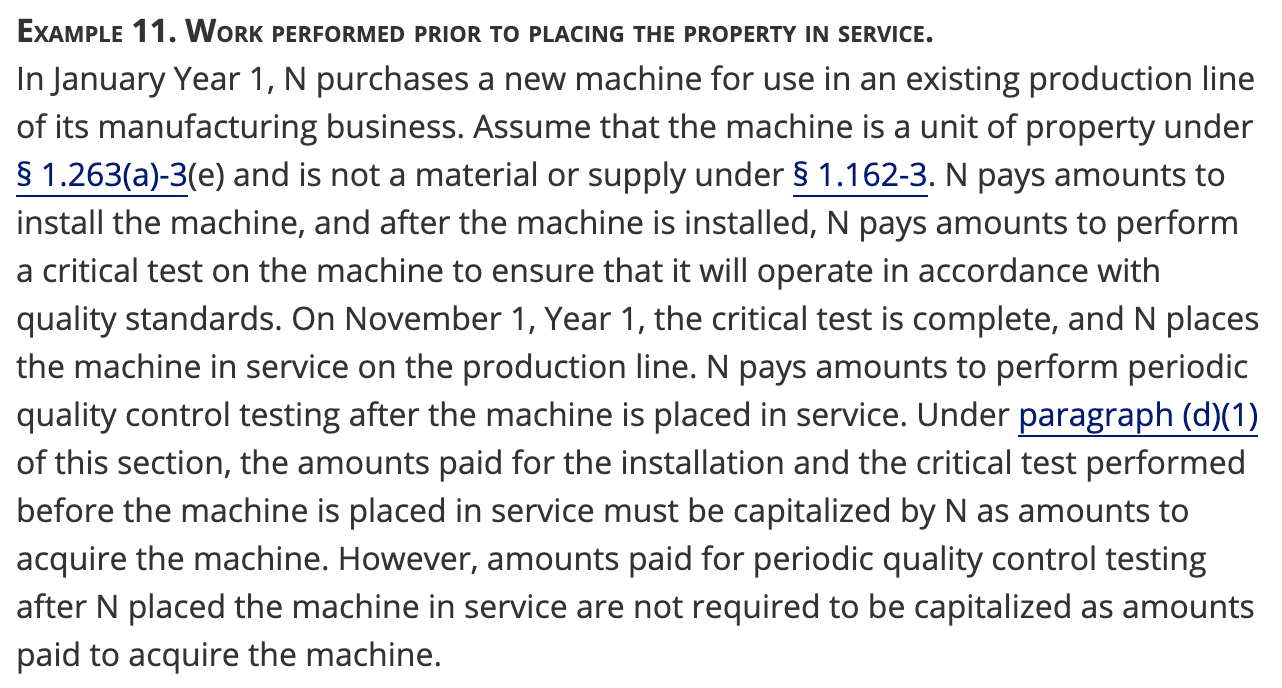

Treas. Reg. §1.263(a)-2(d)(2), Ex. 11, which is one of the repair and capitalization regulations, provides a valuable example that clearly distinguishes between the installation date and the placed in service date:

In this example, the installation date preceded and was distinct from the placed in service date. It is reasonable to take the §25D credit in the tax year in which the system was entirely placed on the property, regardless of whether it has been permitted or connected to the electrical grid.

There are two reasons why claiming the §25D credit in the earliest tax year possible helps the taxpayer:

The sooner the tax savings gets into the taxpayer’s pocket, the more they can earn off of those savings, and

Unused §25D credits must be carried forward, so claiming the credit earlier means any unused credits will be used more quickly.

Here is an example: on August 1, 2022, June paid $30,000 to install a solar electric system on her primary residence. The system was fully installed on November 15, 2022; however, the utility must inspect it and connect it to the electric grid. The utility completes its testing and connects it to the electric grid on February 1, 2023, and the system begins generating electricity.

The solar electric system was installed on November 15, 2022, and placed in service on February 1, 2023. The taxpayer should claim the $9,000 §25D credit (30% of $30,000) in tax year 2022. If June’s 2022 federal tax liability is less than $9,000, she will carry over the unused §25D credit to tax year 2023.

New Paid Subscriber Feature

Today I’m announcing a brand new addition to my Substack publication: the Tom Talks Taxes paid subscriber chat.

This is a conversation space in the Substack app that I set up exclusively for my paid subscribers — kind of like a group chat or live hangout. I’ll occasionally post short prompts, thoughts, and updates that come my way, and you can jump into the discussion.

To join our chats, you’ll need to download the Substack app, now available for both iOS and Android. Chats are sent via the app, not email, so turn on push notifications so you don’t miss a conversation as it happens.

My chat this week, “Hi everyone! What issues are you facing for last-minute returns? Let’s discuss here!” has created a robust discussion with over 50 comments!

Join Me in Reno This Summer

Want more education on energy tax credits? I will be teaching “Tax Credit Bonanza: Inflation Reduction Act 2022” (and three other classes) at the California Society of Enrolled Agents Super Seminar in June 2023 in Reno, NV.