Tax News Roundup - October 2025

Important tax news you need to know

This month’s Tax News Roundup reviews the following news items:

Government Shutdown Update

Tips Deduction Proposed Regulations

Additional Postponement for Israel, Gaza, West Bank

Electronic Payment Mandate (paid subscribers only)

Roth Catch-Up Contributions Final Regulations (paid subscribers only)

Cannabis Businesses and the §199A Deduction (paid subscribers only)

Government Shutdown Update

The federal government shutdown continues with no end in sight. The IRS shutdown contingency plan indicated that supplemental Inflation Reduction Act funding would be used for five business days through October 7, 2025. Starting October 8, some IRS employees received furlough notices; the extent of the furloughs is unknown.

Update since publication: most IRS operations are closed per the IRS website.

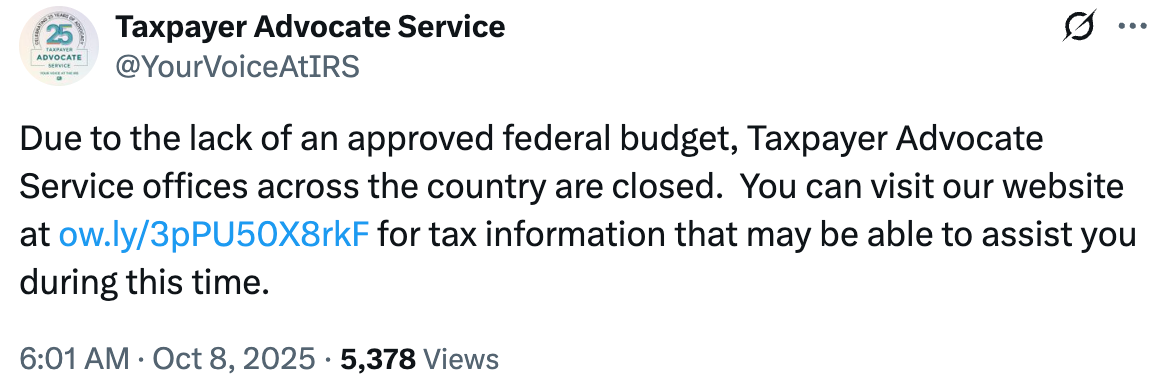

The Taxpayer Advocate Service is now closed, according to their post on X/Twitter:

The U.S. Tax Court announced that if the government remains shut down on October 14, 2025, at 5:00 p.m. ET, it will cancel all trial sessions starting October 20, 2025, and October 27, 2025. The Clerk’s Office remains open for eFiling and paper filing of Tax Court petitions, so there is no extension of the time to file a Tax Court petition under §7451(b).

Tips Deduction Proposed Regulations

The Treasury Department released proposed regulations for the new §224 tips deduction. Comments on the proposed regulations are due October 23, 2025. Much of the proposed guidance is unsurprising and comports with the statutory analysis; see our previous edition for an overview of this new deduction.

Below are items of particular interest from my initial review of the document.

Prop. Treas. Reg. §1.224-1(a) provides no exception is provided for otherwise qualified tips that are either (1) not reported on a third-party information return or Form 4137 or (2) would be reported on a third-party information return except that the reporting threshold was not met. As a reminder, the Form 1099-K threshold was increased retroactively to 200 transactions and $20,000 in sales.

Prop. Treas. Reg. §1.224-1(c) says that cash tips do not include items paid in any medium other than cash, such as event tickets, meals, services, or other assets that are not exchangeable for a fixed amount in cash (such as most digital assets). The digital asset reference to “assets not exchangeable for a fixed amount in cash” is puzzling since many digital assets are readily exchangeable for cash (see Notice 2014-21, for example, for convertible virtual currency).

There is an anti-abuse rule to prevent charging below market value services to increase tips by clarifying that tips are amounts paid by customers for services in excess of the amount agreed to, required, charged, or otherwise reasonably expected to have to be paid for the services in an arms-length transaction.

Treasury created a workaround for mandatory service charges to be qualified tips. If a customer is expressly provided an option to disregard or modify amounts added to a bill, the amounts are not mandatory and qualify as a tip.

The proposed regulations add four restrictions on the qualified tip definition that do not appear in the statute: illegal activities, prostitution, pornography, and tips by owners. What constitutes pornography, of course, is in the eye of the beholder and will lead to confusion when applying the deduction. As Justice Potter stated in Jacobellis v. Ohio, 378 U.S. 184 (1964):

I shall not today attempt further to define the kinds of material I understand to be embraced within that shorthand description, and perhaps I could never succeed in intelligibly doing so. But I know it when I see it, and the motion picture involved in this case is not that.

Prop. Treas. Reg. §1.224-1(d) fails to clarify what deductions are attributable to the trade or business for applying the net income limitation on the qualified tips deduction. For example, the §199A regulations explicitly include the self-employed health insurance deduction, the self-employed retirement plan deduction, and the deduction for 1/2 of self-employment tax in determining qualified business income; these regulations are silent on specifics.

Prop. Treas. Reg. §1.224-1(e) explicitly states that taxpayers with an Individual Taxpayer Identification Number (ITIN) rather than an SSN cannot use their tips to claim the deduction. In addition, married taxpayers must include the SSN of the taxpayer who earned the qualified tips that are being used to claim the deduction; if both spouses earned qualified tips for the deduction, they must include both SSNs on their tax return.

Prop. Treas. Reg. §1.224-1(f) provides the list of professions that customarily received tips on or before December 31, 2024; however, a taxpayer must still apply the §199A specified service trade or business (SSTB) limitation to determine if a taxpayer can claim the tips deduction. Under §224(d)(2)(B), if someone receives tips in the course of a business that is an SSTB, or is employed by an SSTB, those tips are ineligible for the deduction. This can lead to confusing outcomes for taxpayers.

For example, a pianist works as a self-employed contractor at a wedding and receives tips. The occupation (entertainers and performers) is permitted, but their business is an SSTB (performing arts); therefore, those tips are ineligible for the deduction. However, if a hotel employs the same pianist as an employee to entertain guests, those tips are eligible for the deduction. The pianist is in a permitted occupation (entertainers and performers) and their employer, the hotel, is not an SSTB.

Additional Postponement for Israel, Gaza, West Bank

In Notice 2025-53, the IRS again postponed most time-sensitive tax actions for affected taxpayers (e.g., taxpayers living in the area) until September 30, 2026, since it is affected by a “terroristic or military action” under §7508A(a). This postponement overlaps with the relief provided in Notices 2024-72 and Notice 2023-71 such that most time-sensitive actions since October 7, 2023 are now further postponed to September 30, 2026.