Presenting and Reporting S Corporation Distributions in Excess of Stock Basis

A frequent question in various tax forums involves how to present and report S corporation distributions in excess of the shareholder’s stock basis on both the corporation’s Form 1120-S and the shareholder’s Form 1040.

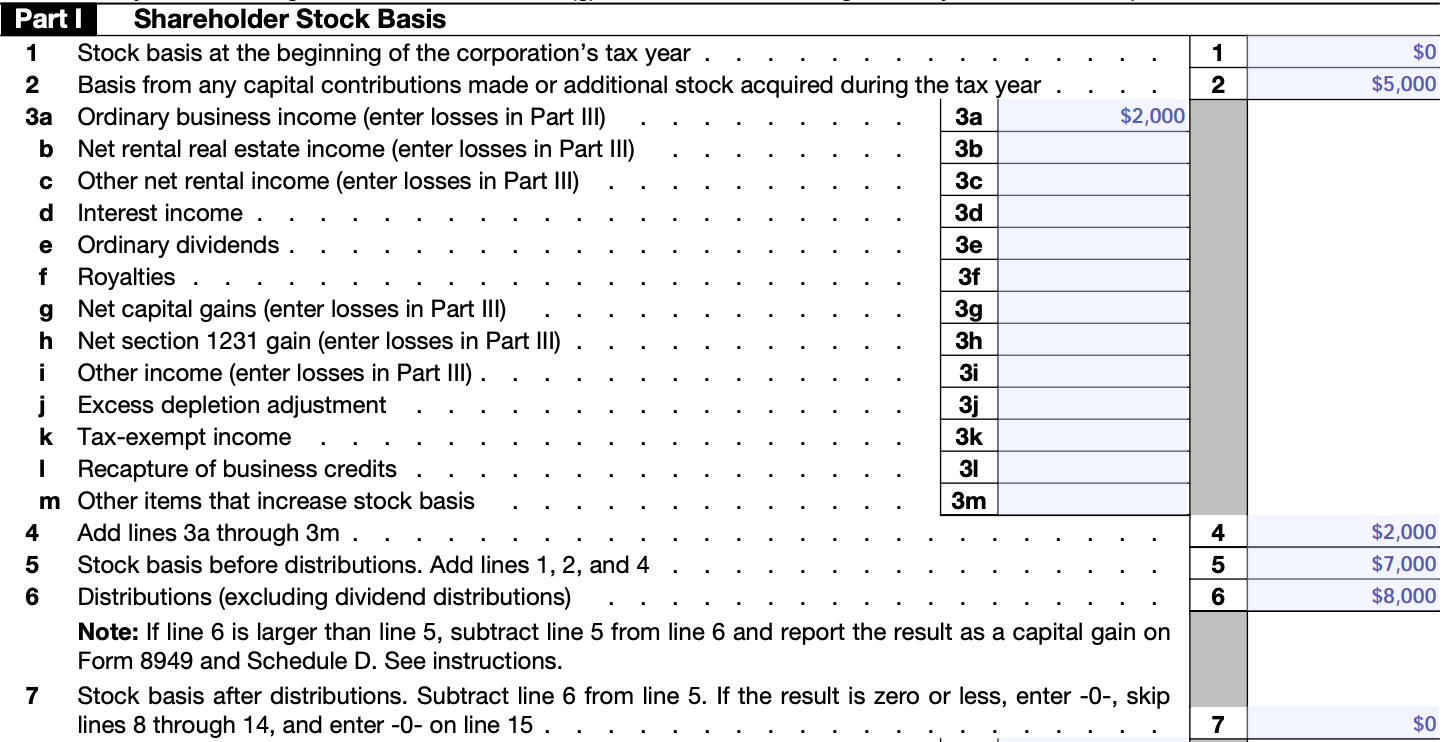

To demonstrate the presentation and reporting, let’s use an example. Robert, the 100% shareholder of ABC Corporation, an S corporation, contributed $5,000 in cash in exchange for the S corporation stock on January 1, 2022. The S corporation had $2,000 in nonseparately stated income during tax year 2022 and made an $8,000 distribution to Robert on December 31, 2022.

The analysis below assumes that the S corporation has no earnings & profits (E&P) from a prior C corporation period.

Shareholder Considerations

If an S corporation shareholder receives distributions in excess of their stock basis, §1368(b)(2) states that the amount taken in excess of stock basis is treated as gain from the sale or exchange of property. Whether it is short-term or long-term gain depends on the shareholder’s holding period in the S corporation stock. The holding period starts on the day after the owner acquired the stock; see Rev. Rul. 66-7.

§1367(a)(2) states that S corporation stock basis cannot go below zero. The gain recognized by the shareholder by the distribution in excess of the stock basis does not increase the shareholder’s stock basis from zero.

Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations, must be filed if a shareholder receives distributions from an S corporation. Here is the proper completion of Robert’s 2022 Form 7203:

Line 6 reiterates that distributions in excess of S corporation stock basis should be reported as capital gain income on Form 8949, Sales and Other Dispositions of Capital Assets.

Here is how Robert’s excess distribution amount could be presented on Form 8949:

Corporation Considerations

With respect to the balance sheet, shareholder distributions reduce the corporation’s retained earnings. In this case, the distribution to Robert causes retained earnings to go below zero. The $5,000 capital stock entry remains to memorialize the amount contributed to the corporation in exchange for the stock.

ABC Corporation’s balance sheet could be presented as follows:

The accumulated adjustments account (AAA) is an S corporation account that tracks the undistributed earnings of a corporation during the S corporation period. Treasury Regulation §1.1368-2 outlines the rules for calculating and maintaining the AAA.

While S corporation losses can drive the AAA below zero, S corporation distributions cannot. In addition, capital contributions to the corporation do not increase the AAA.

Here is a comparison between ABC Corporation’s stock basis, AAA, and balance sheet retained earnings:

It is important to note that if an S corporation has distributions in excess of basis, it will usually create a discontinuity between the book retained earnings and the AAA that will carry forward to future tax years.

Additional Considerations

An S corporation shareholder could have a debt basis in the S corporation if they lent funds to the S corporation. While debt basis can allow losses once stock basis is exhausted, it cannot be used to avoid gain from distributions in excess of stock basis.

If a pass-through entity has a debt-financed distribution to partners or shareholders, the recipients must trace their use of the funds received to determine if the related interest expense incurred by the pass-through entity is deductible. The pass-through entity must separately state the interest expense on the owner’s Schedule K-1; it is the owner’s responsibility to trace the use of the funds and determine if the interest is deductible on the owner’s tax return. See Notice 89-35 for additional information related to debt-financed distributions.

Some practitioners attempt to avoid distributions in excess of stock basis by arbitrarily reclassifying a distribution as a loan. If it is not a bona fide loan (evidenced by a note, appropriate stated interest rate, and payments made per the note terms), the IRS will not respect the loan characterization and will instead treat it as a distribution.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please look at my Linktree to learn about the educational opportunities I offer the tax professional community.

It's really great to see alot of related topics/items concerning S-Corp distributions brought together and discussed with clarity and even illustrations.