OB3 Act: Planning for the "SALT Spot"

Individuals in the $500,000 to $600,000 income range should consider immediate shifts

Thanks to the One Big Beautiful Bill Act (OB3 Act), taxpayers with incomes near the $500,000 to $600,000 range have important tax planning considerations starting in tax year 2025 due to several new or changed provisions.

I’ll review the provisions first, then use a projected 2026 example to demonstrate how they work together to change a taxpayer’s federal income tax liability significantly.

State and Local Tax Deduction

§70120 of the OB3 Act modified and enhanced the state and local tax (SALT) itemized deduction for tax years 2025 through 2029.

The maximum SALT deduction for all filing statuses (except married filing separately (MFS), which is 50% of the normal amount) is $40,000 in 2025 and $40,400 in 2026. The maximum SALT deduction is reduced by 30% of the taxpayer’s modified adjusted gross income (MAGI) exceeding $500,000 in 2025 and $505,000 in 2026 (except MFS, which is 50% of the normal amount). MAGI is AGI plus amounts excluded under §911, §931, or §933. Regardless of the taxpayer’s MAGI, the taxpayer’s maximum SALT deduction cannot be decreased below $10,000 ($5,000 MFS).

Read more about the SALT deduction provision in this Tom Talks Taxes edition.

§199A Deduction

§70105 of the OB3 Act made the §199A deduction permanent at a 20% rate.

In addition, starting in 2026, the wage/income and specified service trade or business (SSTB) limitations phase-in range is increased to $75,000 (or $150,000 on a joint return) of taxable income, versus the current $50,000 (or $100,000 on a joint return).

For 2025, the §199A limitations phase in over the following taxable income ranges:

Joint: $394,600 to $494,600

All others: $197,300 to $247,300

In 2026, the §199A limitations will phase in over the following taxable income ranges:

Joint: $400,000 to $550,000 ($400,000 is an estimate; announced in late 2025)

All others: $200,000 to $275,000 ($200,000 is an estimate; announced in late 2025)

This allows taxpayers over the §199A limitations threshold to generally get larger §199A deductions than under current law because the limitations take effect more slowly as taxable income increases.

Charitable Contribution Deduction Floor

§70425(a) of the OB3 Act adds a 0.5% AGI floor on itemized deductible charitable contributions. Amounts disallowed under the new 0.5% AGI floor are only carried forward if carry forwards arise from other provisions (e.g., cash charitable contributions exceed 60% of AGI). This change applies starting in tax year 2026.

Example

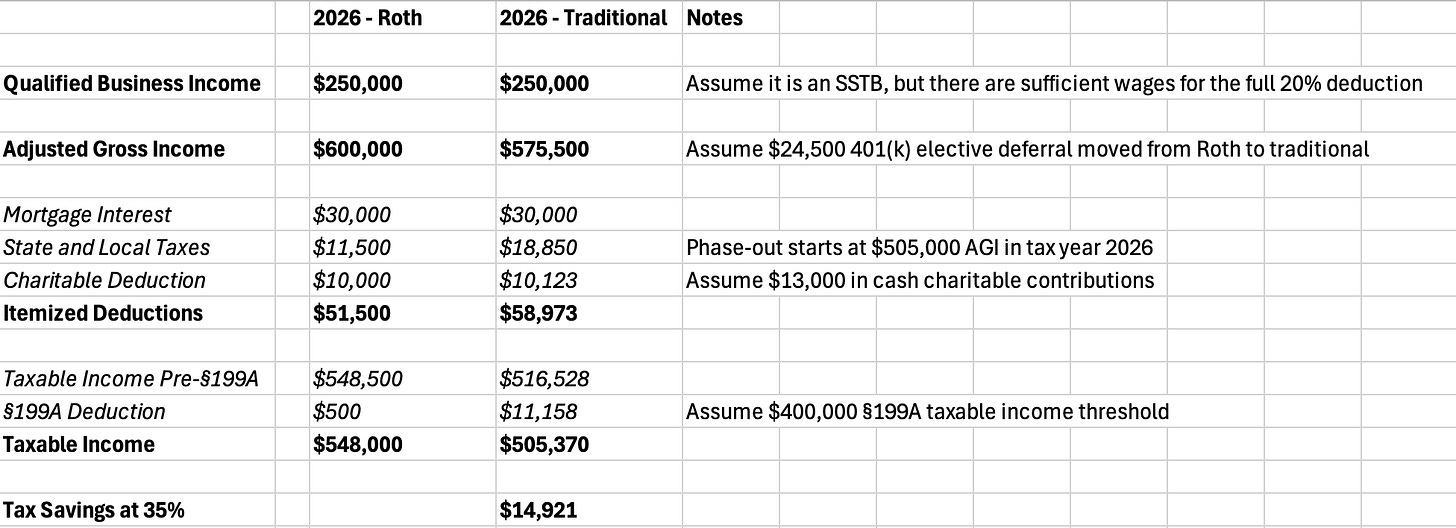

Let’s assume a married couple in tax year 2026 has $600,000 AGI, with $250,000 in §199A qualified business income (QBI) from a §199A specified service trade or business (SSTB), $30,000 in mortgage interest, $13,000 in cash charitable contributions, and $25,000 in state income taxes paid.

If they do the maximum 401(k) elective deferral, let’s compare the difference between a Roth contribution (baseline) and a pre-tax traditional contribution (the change).

Assuming the entire tax reduction is at the 35% marginal rate (which depends on the 2026 tax brackets), there is a significant change in federal tax with a relatively small change in federal adjusted gross income (a $24,500 reduction saves $14,921 in tax, assuming the entire taxable income reduction is in the 35% bracket).

Our projection does not include alternative minimum tax (AMT) calculations; however, based on the tax attributes presented, AMT should not be a material factor.

AMT Troubles in 2026 and Beyond

For tax year 2025, the exemption amount for unmarried individuals increases to $88,100 ($68,650 for MFS) and begins to phase out at $626,350. For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700.

§70107 of the OB3 Act made permanent the increases to the AMT exemption amounts and phaseout thresholds; however, the phaseout thresholds revert to 2018 levels for tax year 2026 ($1 million for a joint return, and $500,000 for all others) and are inflation-adjusted going forward. The provision also increases the exemption phase-out rate from 25% to 50%. This change applies starting in tax year 2026.

Based on these changes, some additional taxpayers may be subject to AMT. However, since the SALT deduction has a cap and miscellaneous itemized deductions subject to the 2% of AGI floor are permanently terminated, AMT will generally be limited to taxpayers with specific AMT preference items (e.g., incentive stock options).

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.