Learn All About the IRS ENMOD Transcript

It is key to understanding how the IRS views an entity

We welcome Josh Youngblood, EA, CRETS, as a contributor to Tom Talks Taxes. Josh is an Enrolled Agent who focuses on tax preparation, planning, and representation and is an emerging speaker on tax and technology topics. He is also a partner at Financial Guardians, LLC, which focuses on cybersecurity education and support for financial professionals. Visit josh.tax and @joshyoungblood on all social media channels.

The IRS offers a variety of transcripts for tax professionals to use to resolve tax matters for their clients. The ENMOD transcript is one of the most specialized transcripts, yet many do not know it exists. This article will discuss an ENMOD transcript, its importance, and how to use it with examples.

ENMOD Transcript Overview

The ENMOD (Entity Module) transcript is an internal IRS transcript that provides comprehensive entity information about a taxpayer. This includes details about the entity’s account, such as its name, address, tax status, and any changes over time. The ENMOD is primarily used to track a taxpayer's historical information and status changes related to their business.

Here are the core elements of an ENMOD transcript:

Basic taxpayer details: Name, address, SSN or EIN,

Entity history: Changes to the entity, such as address changes or entity elections (e.g., S corporation election),

Disaster postponements,

Filing history: Information about filed returns, the tax periods covered, and potential outstanding issues like penalties or collection statuses,

Filing requirements: Returns that the IRS expects the taxpayer to file (e.g., Form 940, Form 941, Form 1120), and

IRS actions: Notices sent to the taxpayer, IRS audits or examination activity, and specific IRS actions taken on the account.

Specific information that can be found on an ENMOD transcript includes but is not limited to:

The entity’s filing status, i.e., C corporation, partnership, etc.,

Whether the taxpayer has filed Form 8832, Entity Classification Election, to elect a filing status other than the default filing status,

Whether the entity filed Form 2553, Election by a Small Business Corporation, to make an S corporation election, or if the entity filed Form 8869, Qualified Subchapter S Subsidiary Election,

The entity’s tax year-end and whether the entity has filed Form 1128, Application to Adopt, Change, or Retain a Tax Year, and

The name of a parent corporate entity, if applicable.

While the ENMOD transcript is not as widely known as the account, return, or wage and income transcript, it offers significant information that can help a practitioner resolve entity-related issues.

Obtaining an ENMOD Transcript

ENMOD transcripts are unavailable via the IRS’s Transcript Delivery System (TDS). Instead, the IRS accesses them internally and allows authorized representatives to obtain them through Form 2848, Power of Attorney and Declaration of Representative (POA), or Form 8821, Tax Information Authorization (TIA).

The POA or TIA must meet the following requirements:

ENMOD must be listed under Matter (POA) or Type (TIA), and the years listed must cover all of the entity’s existence. For example, if ABC, LLC was created in 2019, 2019 to 2024 must be listed under years or periods.

Box 4 must be checked: “Specific use not recorded on Centralized Authorization File (CAF).” The CAF unit does not record authorization for an ENMOD when it processes a POA or TIA.

Your POA or TIA must be wet-signed by the taxpayer. Since you must fax this to the IRS representative, they will not accept an electronic signature.

Be prepared: the representative will ask why you need an ENMOD transcript; you can say, “Federal tax matters.” The representative may not know what an ENMOD transcript is or may be hesitant to provide it. They will also read a disclosure to you that receiving information via fax is not secure and that you are assuming responsibility for that. It will take them a few minutes to prepare the ENMOD as they must redact certain data on the transcript.

Reading the ENMOD Transcript

While most of the common IRS transcripts make sense, the ENMOD is cryptic. It is comprised of a series of codes that can be interpreted by reviewing Document 6209. Referencing Document 6209 to understand codes or transactions reflected on transcripts will be essential since the transcript is mainly intended for internal IRS use.

Some of the codes that could be seen on an ENMOD transcript include, but are not limited to, the following:

076 - Acceptance of Form 8832 (corporate election for LLC)

078 - Rejection of Form 8832

079 - Revocation of Form 8832

090 - Acceptance of Form 2553

090R - Indicates a revision or reprocessing of Form 2553, such as when a correction or additional documentation is submitted.

091 - Revocation / Termination of S election processed

092 - Records the correction of an erroneously posted TC 090, 093, or 095

093 - Form 2553 received but not processed

095 - Revocation / Termination of S election received but not yet processed

150 - Indicates that the IRS has received and processed the taxpayer's return

960 - Indicates a request for penalty abatement

013 - Entity established in the IRS system

016 - An entity’s name or address has been changed

ENMOD Transcript Examples

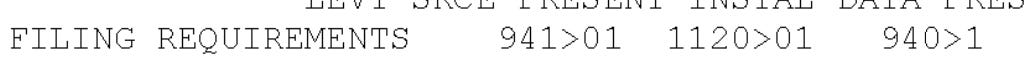

Page 2 of the ENMOD shows the entity's return filing requirements. The ENMOD snapshot below contains a Form 941 and Form 940 requirement for payroll taxes and a Form 1120 requirement (indicating the entity is taxed as a C corporation).

The effective date and the Fiscal Year Month (FYM) will also be listed. In the example below, an S corporation election was processed on June 13, 2018, with an effective date of April 2, 2018, and a tax year ending in December (which is to be expected for almost all S corporations). There is also a Document Locator Number (DLN) used by the IRS, which was omitted for privacy.

Another useful indicator is the LLC>S indicator, which indicates that the entity is an LLC elected to be taxed as an S corporation. This indicator is usually found on page 2 of the ENMOD:

This snapshot below shows collection information. The “H” is the history record, and the “C” indicates collection activity. This section indicates that an installment agreement, “IAGRE/INPT,” was entered into on July 30, 2014. There are various other letters and collection activities and another installment agreement, “IAGRE/INPT,” entered into on July 6, 2017. The transcript further shows a record of the payments made by the entity.

Conclusion

The ENMOD transcript is an important but often overlooked tool when dealing with entity-level issues, examinations, collections, or disaster relief cases. While it may not be as accessible as other transcripts, obtaining it can be worth the extra effort.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please take a look at my Linktree to learn about the educational opportunities I offer the tax professional community.

Can you discuss the IRS TXMODA transcript?