Draft 2025 Form 1040 Instructions Released

Insights can be gathered from the draft form and instructions

We are in the draft tax form season! Reviewing the 2025 draft and final forms, along with their instructions, will provide vital information for the upcoming tax season.

On November 19, 2025, the IRS released the draft 2025 Form 1040 instructions. Below are some items of note for tax year 2025.

Trump Accounts. Authorized by the One Big Beautiful Bill Act (OB3 Act) in new §530A, this is a new tax-deferred account for children under age 18. They cannot be contributed to until July 2026 and essentially become traditional IRAs in adulthood.

Annual contributions are capped at $5,000 per beneficiary, with some exceptions, and new §128 allows employers to make tax-free contributions to an employee’s child’s Trump account up to $2,500 per year.

New Form 4547 (a surprisingly political form number) will be available to be attached to the 2025 Form 1040 to (1) elect to establish a Trump account for a child and (2) receive the free $1,000 contribution for U.S. citizens born after 2024 and before 2029. The draft Form 4547 or the instructions for Form 4547 are not available.

Whether parents want to use the Trump account for child savings is their choice; however, if a child is eligible to receive the $1,000 taxpayer-funded benefit, they should likely elect to do so, even if it is the only contribution to the account.

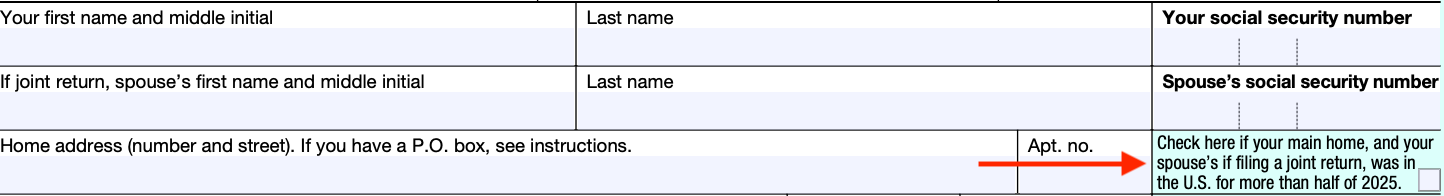

New Form 1040 Checkbox for Main Home Location. If a taxpayer’s main home (and spouse if filing a joint return) was in the U.S. for over half of the tax year, they must check a box on the front of Form 1040. The IRS will use this information to determine eligibility for tax benefits.

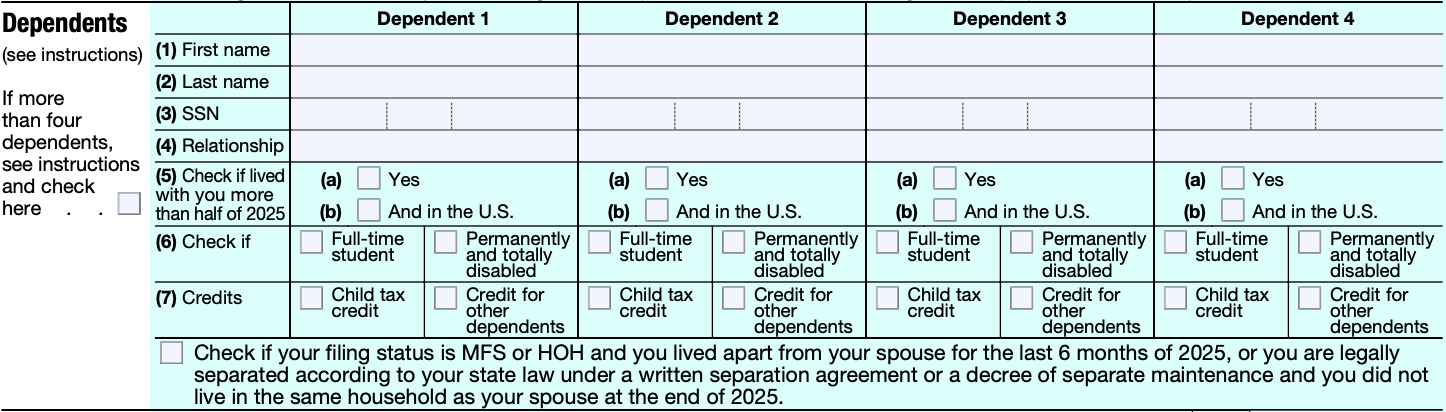

Dependent Section Different. There are significant changes to the dependent section of the 2025 Form 1040. Here was the 2024 version:

Here is the 2025 draft version:

Please note the new question at the bottom of the dependent section. The IRS will use this new information to determine eligibility for the child tax credit, the credit for other dependents, and the earned income credit.

Schedule 1, Line 24z Continues to be Defunct. One of the benefits of the expanded Schedule 1 was the ability to understand what income and deductions were being listed. Lines 8z (income not otherwise listed) and 24z (adjustments not otherwise listed) allowed taxpayers to accurately reflect items not listed on Schedule 1.

For example, when a taxpayer receives multiple Form W-2Gs, it is helpful to make a line 24z Form W-2G adjustment so that the correct gambling gains are reported on Schedule 1, thereby avoiding the threat of an IRS matching notice.

Last year, the instructions specified that line 24z should be left blank, and it was not possible to e-file a tax return with an entry on line 24z. The 2025 draft instructions contain the same prohibition.

Schedule 1-A Instructions Missing. The draft 2025 Form 1040 instructions omit the instructions for new Schedule 1-A, which contains the new OB3 Act deductions for individuals: tips, overtime, senior, and car loan interest.

The draft Schedule 1-A refers to the instructions multiple times for guidance on how to complete the schedule; this is likely pending further guidance on how taxpayers will report items for tax year 2025, since the IRS declined to require information return reporting for many of these deductions.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Question?

Is BOI [filing] dead in 2026?