This morning, FinCEN opened its BOI E-Filing System. I will take you step-by-step on how I filed the BOI Report (BOIR) for Gorczynski & Associates, LLC. I recommend reading my original article on the BOI reporting requirement for background.

BOI Reporting is Coming Soon

Effective January 1, 2024, the Corporate Transparency Act (CTA) will require most business entities to file an initial report with the Financial Crimes Enforcement Network (FinCEN) to disclose the en…

Because I own two LLCs, I obtained a FinCEN Identifier (FinCEN ID). This allows an individual to input their beneficial owner information, get a code, and provide it to the reporting company. This has two benefits:

It shifts the burden of updating beneficial owner information, for example, an address change, to the beneficial owner and avoids the reporting company having to file an updated report.

It avoids entering information multiple times for an individual who is a beneficial owner of multiple entities.

Getting a FinCEN ID

To get a FinCEN ID, visit the FinCEN ID Application for Individuals. You will need to sign in with a login.gov account. I already had a login.gov account, so I did not have to create one. You must log in with two-factor authentication (2FA) to access this application. Once you log in, you are directed to the FinCEN ID Application.

First, enter your full legal name and date of birth (I'm sorry, you cannot know my age).

Next, enter your address (sorry, I do not want unexpected visitors).

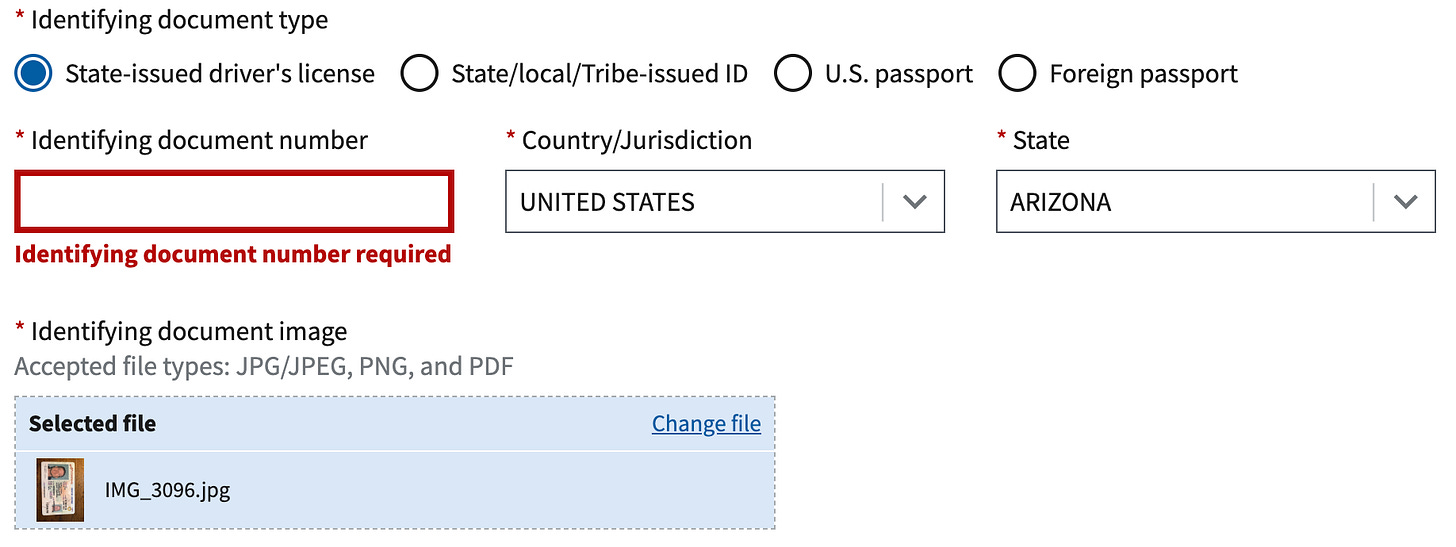

The last piece of required information is an identifying document and an image. Initially, I planned to use my U.S. passport as it is renewed every ten years; however, I had a photo of my Arizona driver’s license readily available, so I used that instead.

Last, you must certify the information provided is true, correct, and complete. Please note the reminder that the willful provision of false or fraudulent information is subject to civil or criminal penalties. A willful action is the voluntary, intentional violation of a known legal duty (see my prior article for more discussion).

Voila! I received my FinCEN ID in less than 10 minutes (the actual ID number is located in two places, but I redacted them in the image below). The submission receipt contains all the information I submitted in the application.

Since a login.gov account with 2FA is required for this application, the individual must get their own FinCEN ID; I don't think this application is intended for third-party preparers to access it (more on this later with respect to the BOIR).

Filing a BOI Report

To file the BOIR, visit the BOI E-Filing System. There is no login requirement to access this system, unlike the FinCEN ID system.

There are two options: the PDF upload or the online system. Anyone who has filed an FBAR knows the PDF upload system, so I opted for the online system.

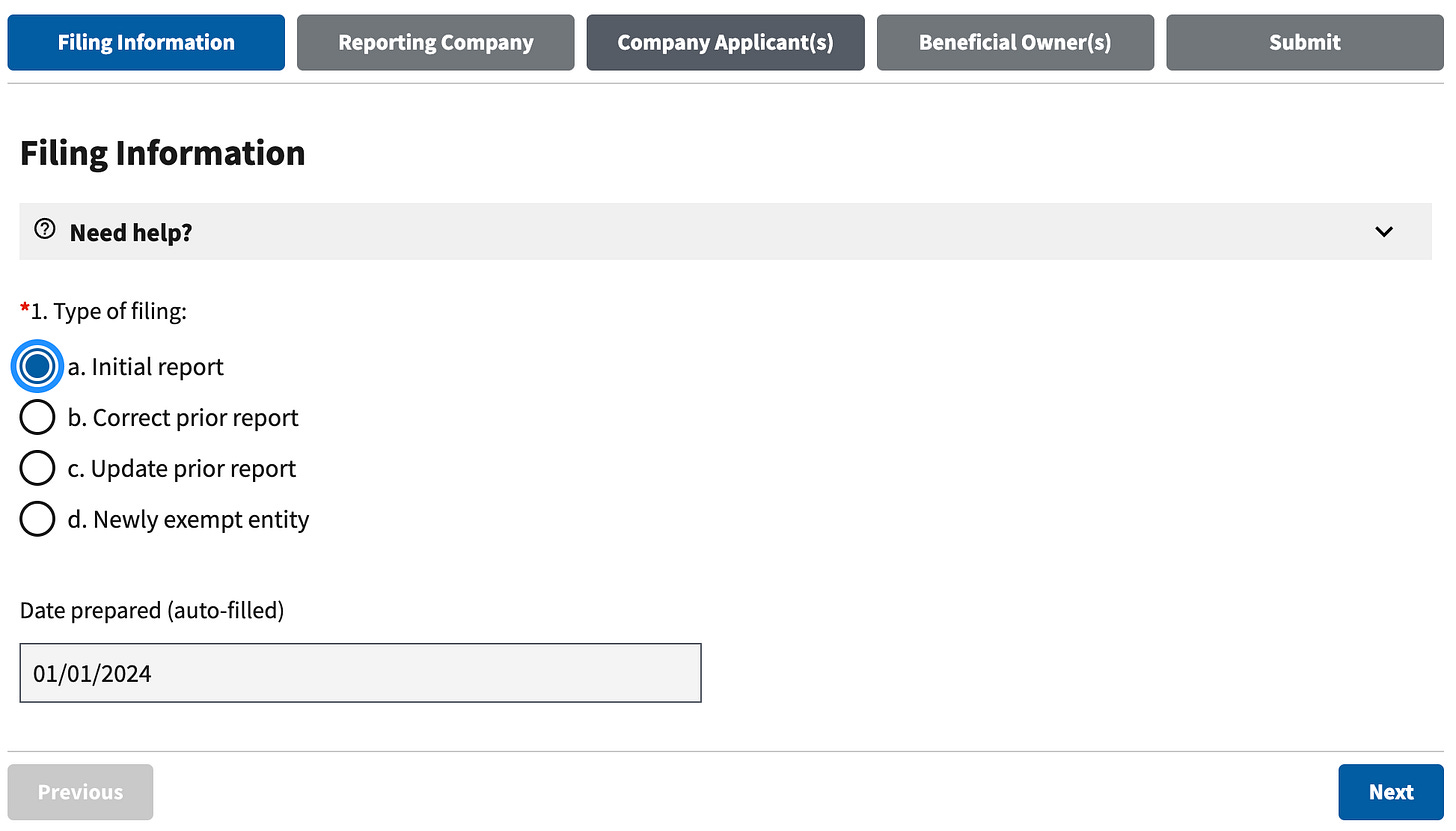

There are five steps to file the BOIR. First, enter the report type and the preparation date (the system auto-populates the preparation date).

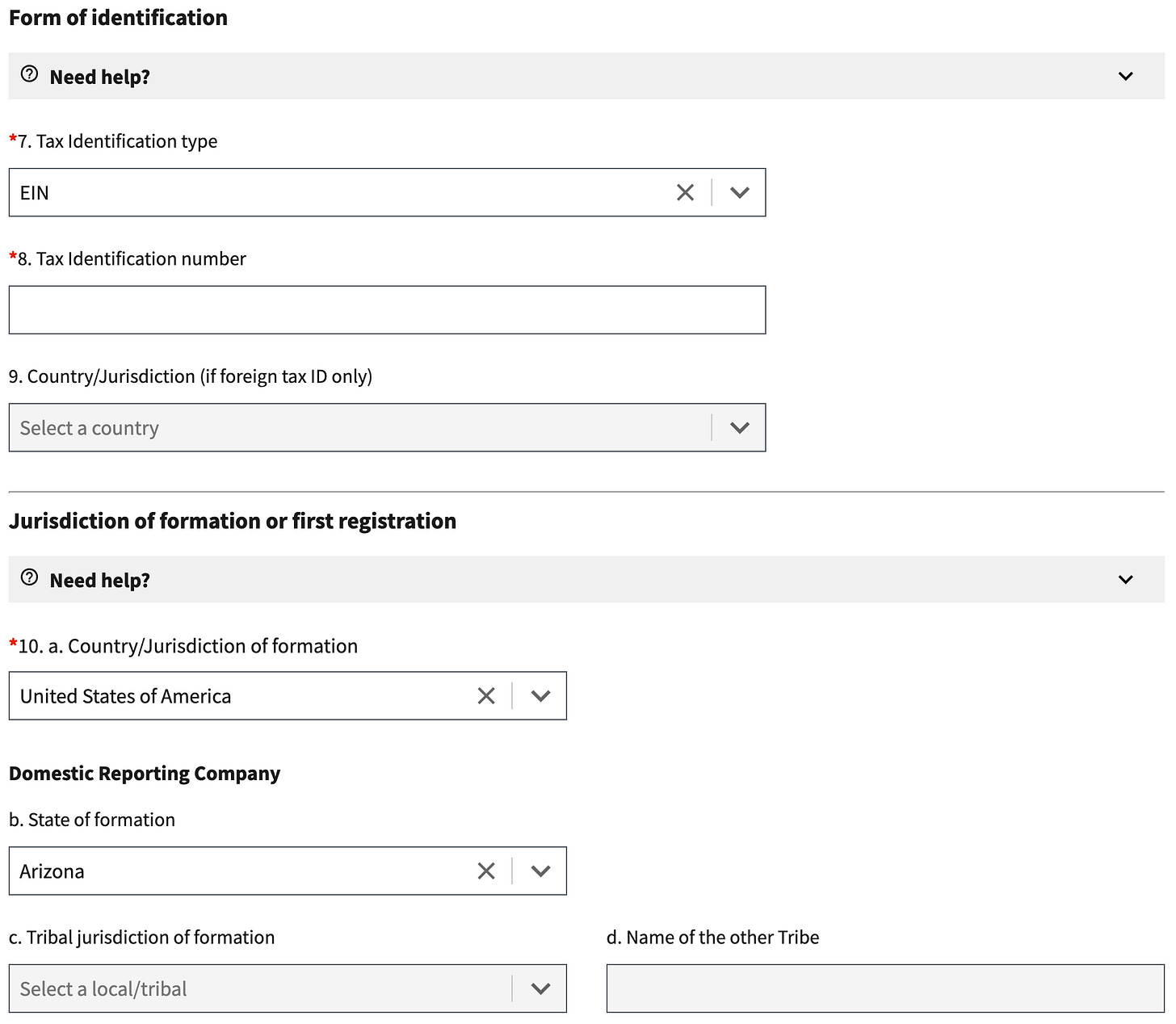

Second, the reporting company provides the required information about itself. A reporting company can request to receive a FinCEN ID by selecting box 3. The reporting company can add a trade name or a “doing business as” (DBA).

The reporting company must provide a tax identification number; one of the options was a Social Security number. I do not think a single-member LLC (SMLLC) with no EIN requirement will have to get an EIN to file the BOIR; however, this is a non-tax reason why an SMLLC may request an EIN when it is otherwise not required to do so.

The reporting company must list the formation jurisdiction; this may be different than the primary location where the entity does business.

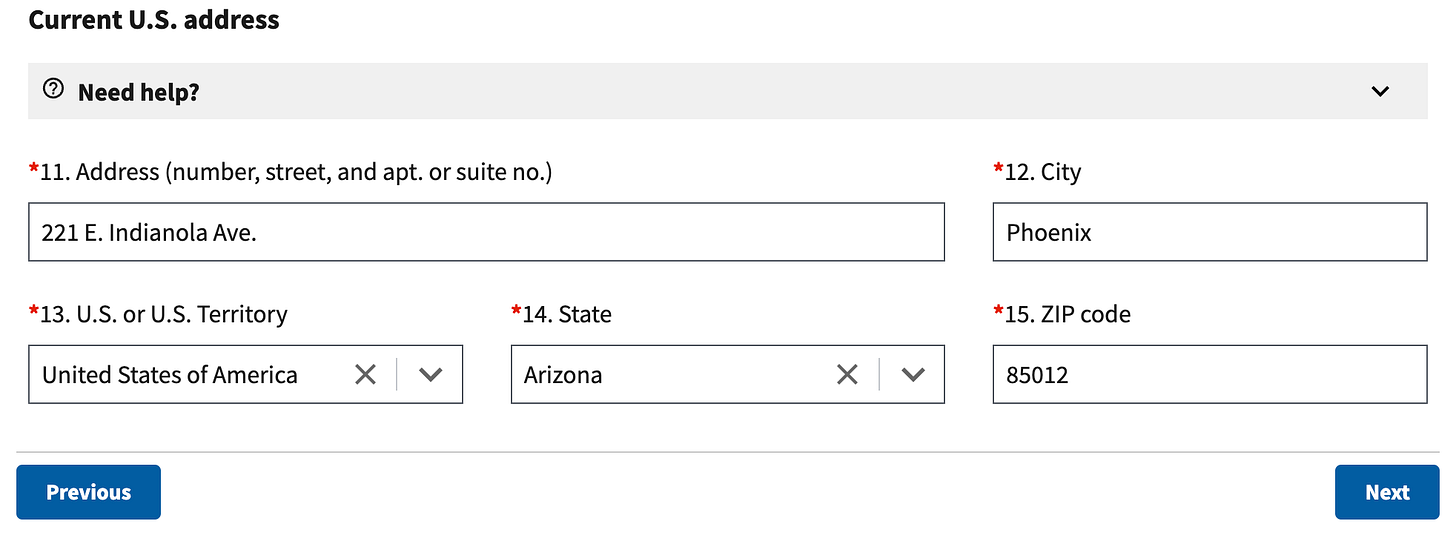

Next, the reporting company must disclose its current U.S. address.

The third section is the disclosure of the reporting company’s company applicant(s). The company applicant is the individual or firm who formed the entity by filing the documents with the Secretary of State or equivalent office. A reporting company that existed as of January 1, 2024 is exempt from providing company application information; be sure to check box 16 to avoid having to complete this section if applicable.

The fourth section is the disclosure of the reporting company's beneficial owner(s). This section was simple for me, as I only had to add the FinCEN ID I obtained earlier. For beneficial owners without a FinCEN ID, the reporting company will have to provide the same information required for the FinCEN ID.

The reporting company can add more beneficial owners by clicking on the “Add Beneficial Owner” blue box in the upper right portion of the screen.

As I live in Arizona, a community property state, I must reiterate that FinCEN has never provided specific guidance on how community property law intersects with beneficial ownership. When preparing FBARs, I am a firm believer in “when in doubt, report” with respect to a foreign account with an uncertain or ambiguous reporting requirement. As such, if a spouse is a 25% owner by operation of community property law, and they do not exercise substantial control, it may be prudent to report them if further guidance does not clarify this issue.

The last section of the BOIR is submitting the report, and the individual submitting the report on behalf of the reporting company must provide their name and email address.

While there is no preparer section of the BOIR, the preparer would complete this section as they are authorized to file the BOIR on behalf of the reporting company. The FinCEN ID system did not have equivalent language.

After submitting the report, the final screen verifies the BOIR was submitted to FinCEN with a BOIR ID and Submission Tracking ID. If the reporting company requested a FinCEN ID, it is displayed on the final screen.

I kept a copy of this confirmation and also downloaded the BOIR transcript, which is a summary of all of the information provided in the BOIR.

Submitting the BOIR took approximately 10-15 minutes, so getting a FinCEN ID and submitting the BOIR took less than 30 minutes. Both FinCEN systems are well-designed, with no problems for me on the initial launch day.

The Tax Professional Role

I recommend that every tax professional complete their BOIR to assess the system and requirements for themselves. Some professional tax preparation software programs will have BOIR filing capacity, and many third-party filing providers have been formed to assist taxpayers in meeting their obligations.

To reiterate what I wrote in my earlier article, there are four paths to helping our small business taxpayers with BOI compliance, and every tax practice should select one of these four options:

Provide education about the requirement. This is the minimum tax professionals should do; education should start in January 2024 and continue during the one-year compliance period.

Provide education and track client self-compliance. For large tax practices, this could require tracking thousands of entities.

Outsource preparation to a third-party firm. Many service providers will assist with BOI compliance; tax professionals can establish a referral relationship with one or more firms.

Prepare the required forms. A tax professional must consider the legal, financial, and operational consequences before offering this service.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please take a look at my Linktree to learn about the educational opportunities I offer the tax professional community.

I'm with you Tom.

No need for others to know how old you are.

I like to dazzle them with my sparkling personality before they notice the wrinkles.

Thank you Tom-pretty straight forward with this information.