Beware This Solar Panel Tax Scam

Tax losses that are too good to be true usually are

The Inflation Reduction Act allows an individual taxpayer to get a 30% personal nonrefundable tax credit for solar electric property under §25D through 2032. For example, a $15,000 solar electric installation (which is on the low end) generates a $4,500 nonrefundable personal tax credit.

Some unethical solar credit promoters are encouraging taxpayers to claim downright false Schedule C business losses with respect to their solar electric property for additional tax savings. A colleague sent me the tax package a solar credit promoter sent to one of her clients. It may be no surprise that it is full of questionable items (and that is a generous characterization).

The tax package provided to the taxpayer contains a two-page single-spaced position statement, a completed Form 5695, Residential Energy Credits, a completed Schedule C, Profit or Loss from Business, and a completed Form 4562, Depreciation and Amortization.

The firm purports it has helped thousands with the tax consequences of their solar electric property (a scary thought):

Issue #1: Credit

The total cost of the solar electric property was $35,493, and the credit claimed on Form 5695 was $10,648, which is 30% of the total cost. The §25D nonbusiness solar electric property credit is claimed on Form 5695.

However, the promoter makes a fundamental error by claiming in its tax package that the taxpayer is claiming the solar investment tax credit (ITC):

There are two credits for installing solar electric property. The §25D residential clean energy credit is in Subpart A of the Internal Revenue Code, which is titled “Nonrefundable Personal Credits” and includes other credits such as the §23 adoption credit, the §24 child tax credit, and the §25A education credit.

The §48 energy credit is for energy-generating property that is of a character subject to depreciation because it is used in an income-producing activity. It is claimed on Form 3468, Investment Credit. The §48 energy credit is in Subpart E of the Internal Revenue Code. Subpart E is titled “Rules for Computing Investment Credit,” and §46 states that the §48 credit and the other Subpart E credits make up the overall investment credit.

While the §25D credit is always 30%, the §48 energy credit is not always 30% — it is actually a 6% base credit rate. The credit may be increased to 30% if the solar electric property installation meets certain additional requirements.

Issue #2: Basis

In its tax package, the promoter applies the §48 basis rules instead of the §25D basis rules. For a §25D credit, the basis increase from the installation is reduced by 100% of the credit amount under §25D(f), while for a §48 credit, the basis is reduced by only 50% of the credit amount under §50(c).

The promoter claims the basis of the solar electric property is $30,169, which is $35,493 less 50% of the $10,648 credit. However, the §25D credit was actually the credit claimed by the taxpayer, so the basis of the solar electric property is $24,845, which is $35,493 less $10,648.

Issue #3: Schedule C

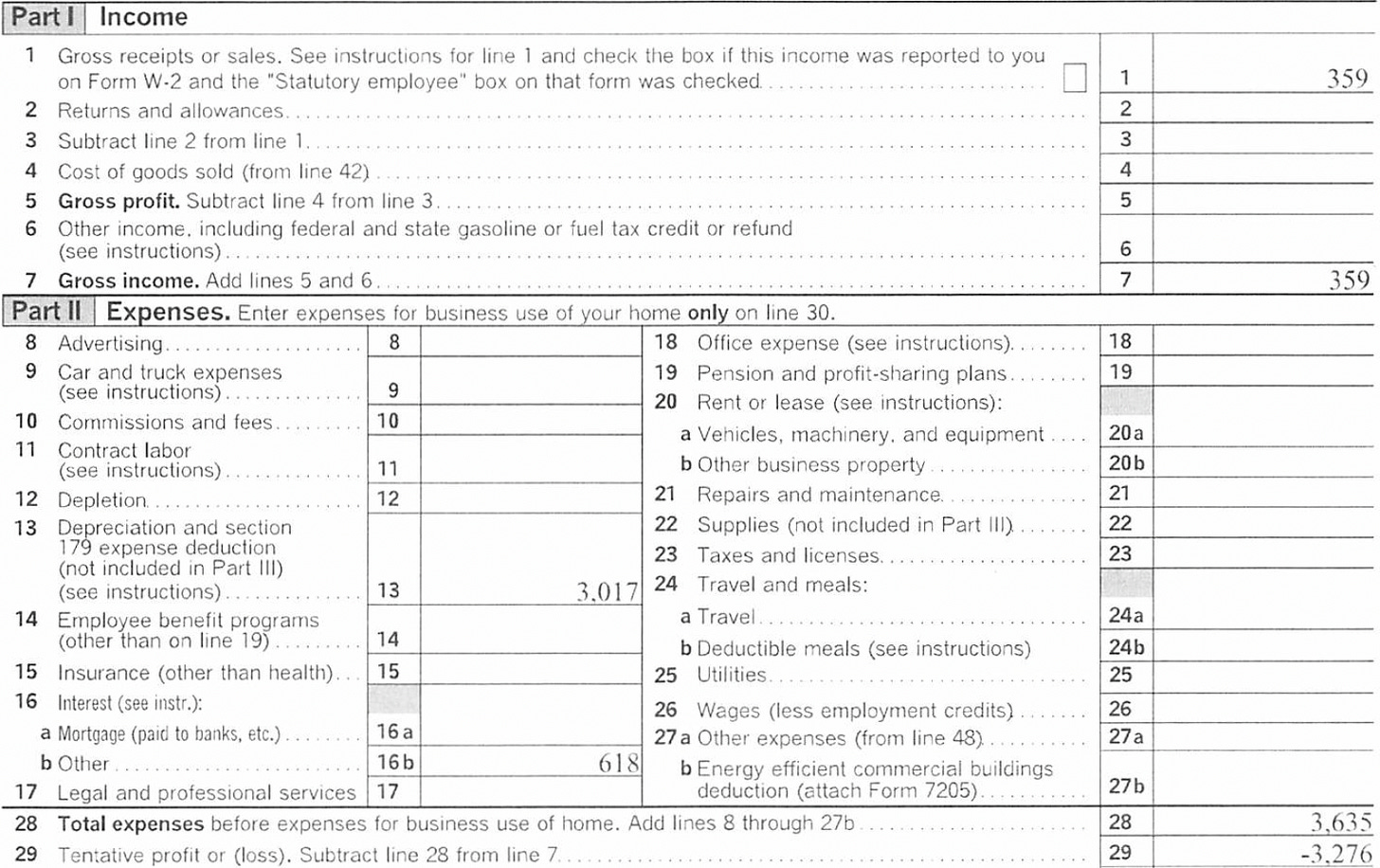

According to the promoter, the solar electric property on the taxpayer’s residence generated a nonpassive $3,276 loss on Schedule C. The promoter provides a long technical-sounding word jumble (without any specific citation to the law or authority) as to why this is a proper treatment. The promoter depreciated 100% of the purported $30,169 basis in the solar electric property.

Here is the 2023 Schedule C provided to the taxpayer:

First, the promoter claims that electric generation activity is a trade or business activity. This is essential to claiming the loss; if it were not a trade or business activity, any purported deductions would be 2% miscellaneous itemized deductions unless otherwise deductible under another Code provision. Here is their justification:

This is all inconsistent with the use of Form 5695 to claim the nonbusiness §25D credit on the entire solar electric property. In Notice 2013-70, the IRS stated the following with respect to the §25D credit:

As discussed in a prior edition, the Supreme Court in Groetzinger provided a general definition of a §162 trade or business (emphasis added):

We accept the fact that, to be engaged in a trade or business, the taxpayer must be involved in the activity with continuity and regularity, and that the taxpayer's primary purpose for engaging in the activity must be for income or profit. A sporadic activity, a hobby, or an amusement diversion does not qualify…

Once the system is activated, the taxpayer has essentially no involvement. The solar energy activity is almost certainly not a trade or business activity for the taxpayer, so there is no deductible loss.

Since the lack of a trade or business activity is fatal to the promoter’s position, there is no need to address in detail all of the other problems, but I will briefly mention them.

The promoter claims that all of the electricity generated by the solar electric property is taxable income, even though most of the electricity is personally consumed. Whether or not excess electricity sold or provided to the utility is a taxable event has never been clearly stated in IRS guidance; however, net metering is likely best viewed as a non-taxable rebate on electricity sold to the individual from the utility.

The promoter claims the solar electric property is 100% depreciable, even though most of the electricity generated is personally consumed. The portion of the system allocated to the personally consumed energy is non-depreciable; an allocation is required if there is business use (in this case, there almost certainly is none). Assuming the purported business use is not “merely incidental and relatively insignificant” then “…The deduction for allocable business use, in these cases, is computed by reference to the ratio of time or space devoted to business as compared with total use.” See International Artists, Ltd. v. Comm., 55 T.C. 94 (1970).

The promoter claims that the taxpayer materially participates in the activity, but then calls it a passive activity (perhaps a Freudian slip?):

However, it is unlikely the taxpayer has any hours that actually count toward material participation as defined in Treas. Reg. §1.469-5T(f). Time spent reviewing operations or financials is work an investor would typically undertake, which are excluded from the material participation determination. In addition, any hours worked for which the principal purpose is to avoid the §469 loss suspension also do not count.

Issue #4: Use Our Preparer

While the promoter provided completed tax forms, they admit that the completed forms may not actually apply to the taxpayer. Also, the taxpayer does not have to worry if their current tax professional thinks this is all illegitimate as the taxpayer can self-prepare using a commercially available program, or the promoter can provide a CPA (not an EA) to prepare the questionable return:

Share Your Thoughts!

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please take a look at my Linktree to learn about the educational opportunities I offer the tax professional community.

Another problem I just noted: they did not use the mandatory §168(k) bonus depreciation even though there was no mention of electing out of §168(k) depreciation.

Thanks Tom for providing your wisdom and experience regarding thinking about more of how to plan out your tax practice better in ways in which to help us all minimize much of the stress and pressure upon on us in trying to provide the best of services to clients, remain in compliance with IRS and at the same time continuing our learning and growing in the professional tax industry......Blessing to you...Kerwin Jordan