A Step-by-Step Guide to Getting an IP PIN

An IP PIN is an important security tool available to all individual taxpayers

In a recent press release, the IRS strongly encouraged all individuals to sign up for an Identity Protection PIN (IP PIN) for the 2025 tax season to help protect against tax-related identity theft. An IP PIN is a six-digit number known only to the taxpayer and the IRS that is used to verify one’s identity when filing tax returns.

The IRS just announced another benefit of using an IP PIN. Beginning in the 2025 filing season, for tax year 2024 returns, the IRS will accept Forms 1040, 1040-NR, and 1040-SS even if a dependent has already been claimed on a previously filed return provided that the primary taxpayer on the second return includes a valid IP PIN. Without this procedure, taxpayers are forced to paper file the second return, leading to delays and frustration.

The IRS maintains an FAQ page about IP PINs that answers many questions; some of the critical items in the FAQs are discussed below.

If a taxpayer receives an IP PIN, it must be included on both electronically-filed and paper-filed returns. An electronically-filed return will only be accepted if the IP PIN is included. A paper-filed return will be subject to processing delays if the IP PIN is omitted. On Form 1040, the IP PIN is entered to the right of the taxpayer's signature:

The IP PIN changes each year, so if a taxpayer receives one, the tax professional must request the new identifier each year. While this is additional work for the tax professional, the security benefits outweigh the potential problems, especially for taxpayers at high risk of misuse of their Social Security number.

A dependent can get an IP PIN. If a taxpayer claims one or more dependents with an IP PIN, they must enter their IP PIN on the electronically-filed Form 1040, Form 2441, Child and Dependent Care Expenses, and Schedule EIC, Earned Income Credit; if they do not, the electronically-filed return will be rejected. A dependent’s IP PIN does not have to be entered on a paper-filed return.

Taxpayers can obtain their IP PIN through their Individual Online Account. However, the IP PIN application will be down for maintenance starting November 23, 2024 through early January 2025. If they do not want to wait, taxpayers should act today.

Step 1: Log into the Individual Online Account

Go to the Individual Online Account page and sign in:

The taxpayer will need to authenticate with ID.me to access their account:

Step 2: Request the IP PIN

Once inside the Individual Online Account, select “Profile” in the upper right:

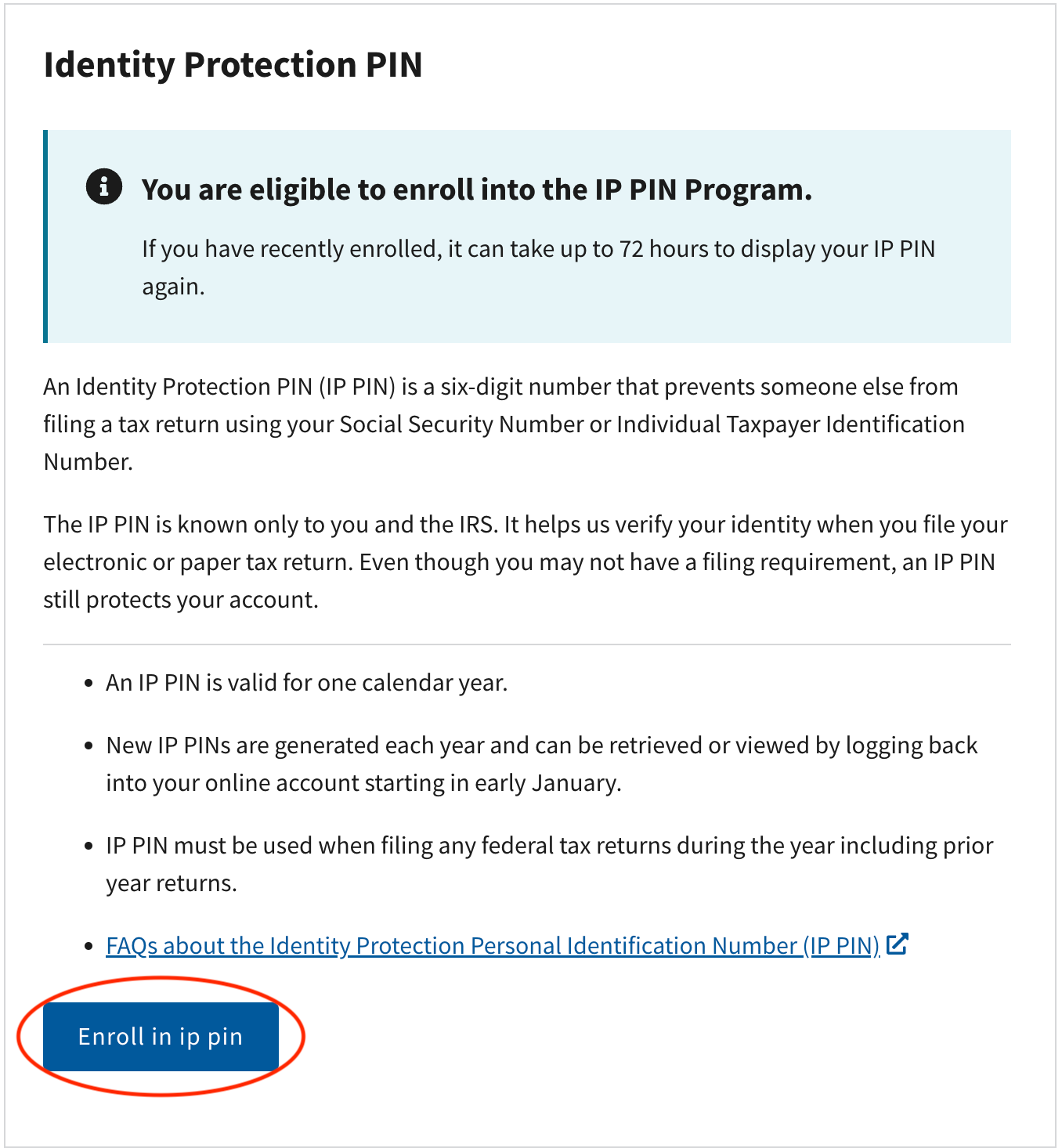

Scroll to the bottom of the profile page and click the “Enroll in IP PIN” button:

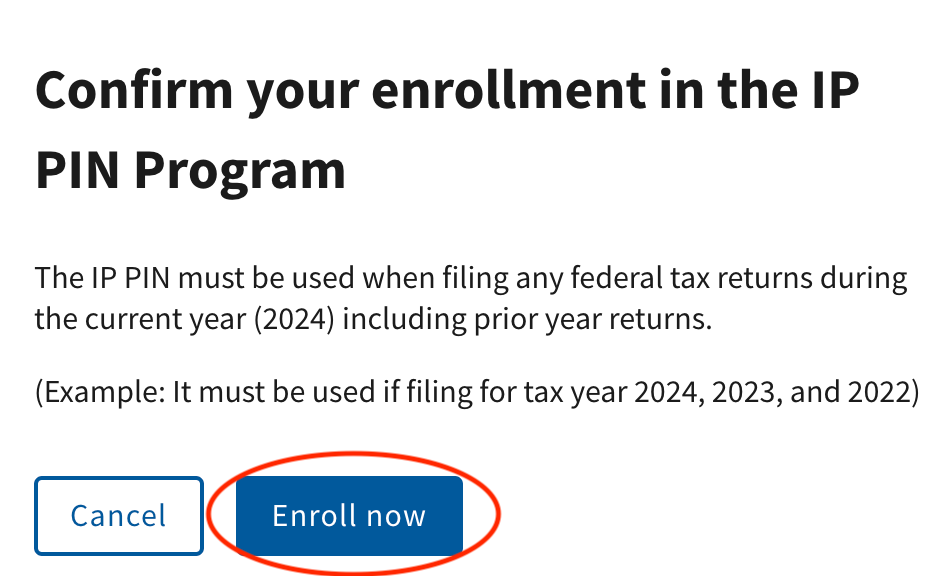

There is a pop-up to confirm your enrollment; click the “Enroll now” button":

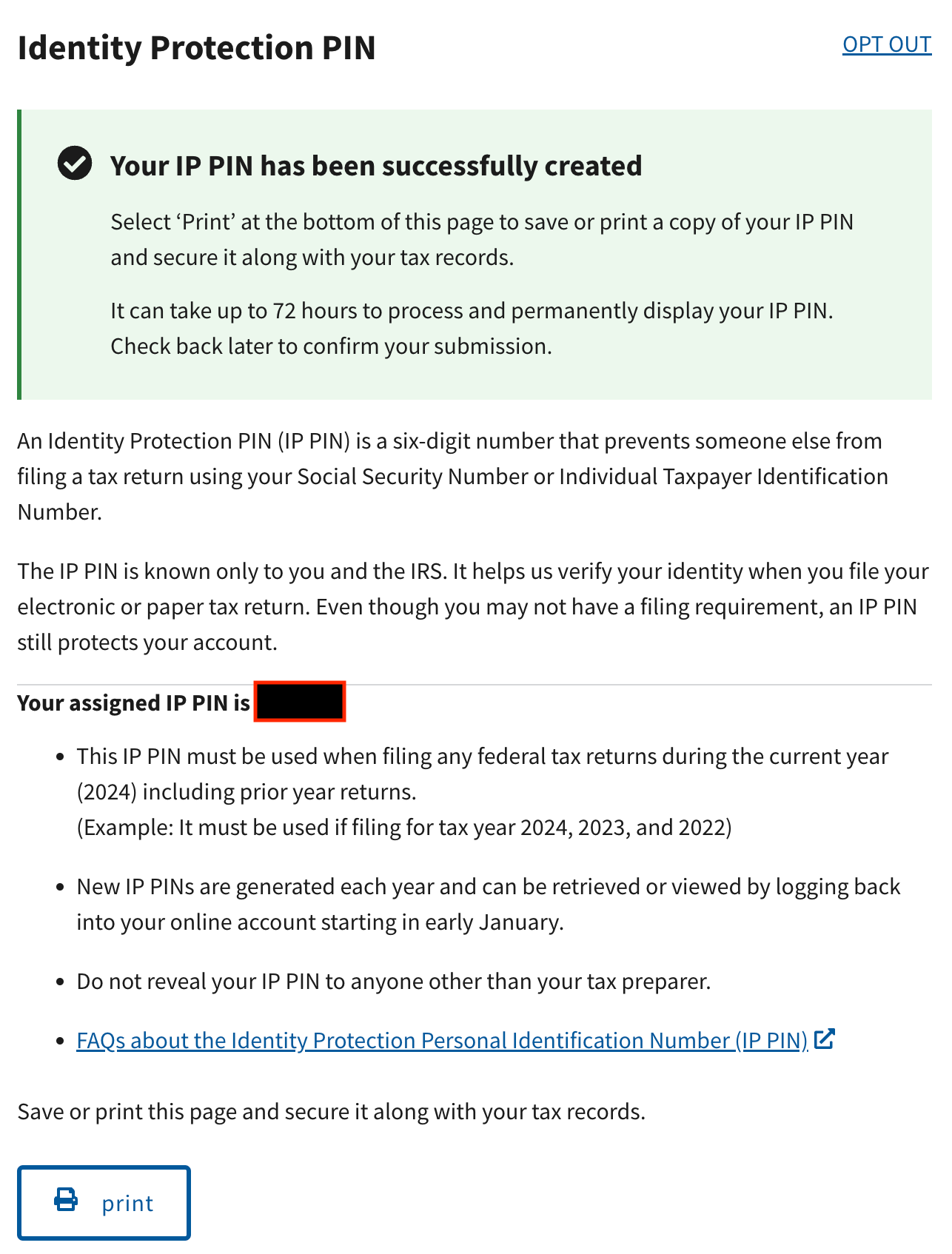

Voila! The taxpayer is now the owner of an IP PIN:

Please note that this IP PIN is for any return filed during 2024. In early 2025, the taxpayer will be issued a new IP PIN for any returns filed in calendar year 2025.

Getting an IP PIN Without an Individual Online Account

If the taxpayer’s adjusted gross income on their last filed return is below $79,000 for Individuals or $158,000 for married filing joint and they cannot establish an online account, they have the option to use Form 15227, Application for an Identity Protection Personal Identification Number.

Looking for More?

Additional education on IP PINs is available through Financial Guardians.

Join the Conversation

As a paid subscriber, you can discuss this topic in the comments section. Please keep the discussion related to this edition’s topic.

Learn More About Tom

Please take a look at my Linktree to learn about the educational opportunities I offer the tax professional community.